This appendix has Form and Report Examples

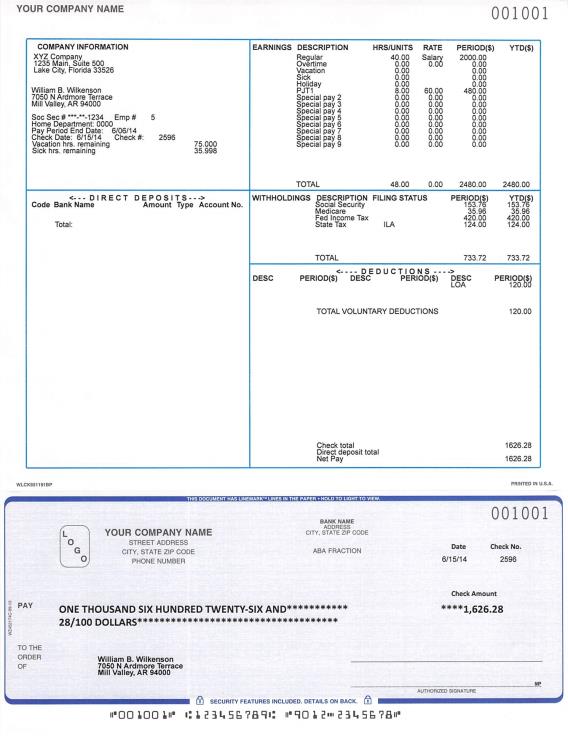

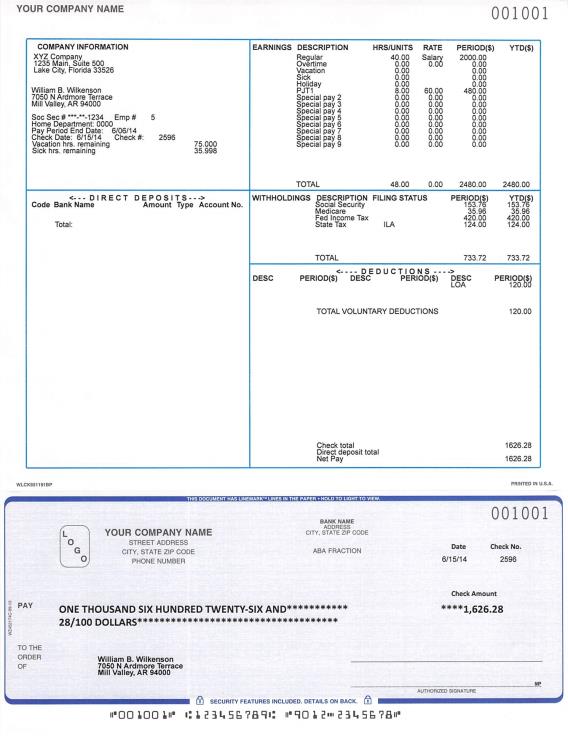

This is an example of the graphical check form:

Date 06/09/2014 Time 13:52:37 XYZ Company Report-#0000000 Page 0009

4 0 1 ( K ) C O N T R I B U T I O N S R E P O R T

Starting pay period date: 11/01/2014 Ending pay period date: "Latest" T after Check# = ACH transaction

------------------------------------------------------------------------------------------------------------------------------------

Emp-# Name Emp-amount Empr-amount Roth-401(k) Emp-soc-sec-no 401k Ded flag

------------------------------------------------------------------------------------------------------------------------------------

10 Prieskorn, Jeff-DD 1 check .00 10.00 50.00 ***-**-8332 Y

12 Schultz, Kenneth J.-DD 1 check .00 10.00 .00 ***-**-7701 Y

Report totals: 2 employees .00 20.00 50.00

-- End of report --

Date 03/04/2011 Time 11:31:17 XYZ Company Report #000000 Page 0002

P A Y R O L L R E G I S T E R H I S T O R Y

Starting date: 01/01/2014 Ending date: "Latest"

Starting employee: 1001 Ending employee: 1002

Entry types: P = payroll check V = advance vacation check A = adjustment B = bonus/separate suppl earning C = commission

Cash account #: "All" T by Check# = ACH transaction * by Check# = split transaction (check/DDP)

------------------------------------------------------------------------------------------------------------------------------------

Emp# Name Typ Check# Chk-date Prd-date Gross Tot-taxes Deductions Net pay Tips+meals

------------------------------------------------------------------------------------------------------------------------------------

1001 Palmer, Edward W. P 2525 1/02/14 1/14/14 50,000.00 27,033.74 170.00 22,796.26

Employee 1001 Totals: 1 trans 50,000.00 27,033.74 170.00 22,796.26

1002 Levine, Susan M. P 2592 1/30/14 4/01/14 9,166.67 3,999.21 65.00 5,102.46

P 2534 2/01/14 3/13/14 9,166.67 4,043.62 65.00 5,058.05

P 2560T 2/01/14 3/13/14 9,166.67 4,043.62 65.00 5,058.05

P 497T 10/31/14 10/31/14 9,166.67 3,999.21 65.00 5,102.46

Employee 1002 Totals: 4 trans 36,666.68 16,085.66 260.00 20,321.02

Grand totals: 2 employees 5 trans 86,666.68 43,119.40 430.00 43,117.28

-- End of report --

Date 06/09/2014 Time 10:11:27 XYZ Company Report-#0000000 Page 0003

P A Y R O L L D I S T R I B U T I O N T O G E N E R A L L E D G E R R E P O R T

Starting account #: 1000-000 Ending account #: "Last" PR = Payroll checks

Starting date: 03/01/2014 Ending date: 03/31/2014 PM = Manual payroll

T after Chk-# = ACH transaction

------------------------------------------------------------------------------------------------------------------------------------

Acct-# Description Chk-date Jrnl-# Cash-account Chk-# Emp-# Distrib-amt

------------------------------------------------------------------------------------------------------------------------------------

1000-000 Cash account #13557-000 03/01/14 PR0100131 1000-000 2528 550 714.00CR

03/17/14 PR1000147 1000-000 2562 10 2,407.05CR

Account total: 3,121.05CR

2100-000 Federal W/H tax payable 03/01/14 PR0100131 1000-000 2528 550 159.50CR

03/17/14 PR1000147 1000-000 2562 10 416.38CR

Account total: 575.88CR

2120-000 FICA taxes payable 03/01/14 PR0100131 1000-000 2528 550 153.00CR

03/17/14 PR1000147 1000-000 2562 10 542.34CR

Account total: 695.34CR

2130-000 FUI taxes payable 03/01/14 PR0100131 1000-000 2528 550 6.00CR

Account total: 6.00CR

2130-100 FUI taxes payable 03/17/14 PR1000147 1000-000 2562 10 20.73CR

Account total: 20.73CR

2150-000 SUI taxes payable 03/01/14 PR0100131 1000-000 2528 550 .72CR

Account total: .72CR

2170-000 401(k) Elective deferrals 03/17/14 PR1000147 1000-000 2562 10 50.00CR

Account total: 50.00CR

2200-400 State sales taxes payable 03/01/14 PR0100131 1000-000 2528 550 50.00CR

03/17/14 PR1000147 1000-000 2562 10 400.00CR

Account total: 450.00CR

2355-100 Employer matching 401k 03/17/14 PR1000147 1000-000 2562 10 10.00CR

Account total: 10.00CR

5120-100 401k Expense accounts 03/17/14 PR1000147 1000-000 2562 10 10.00

Account total: 10.00

6000-000 Administrative salaries 03/01/14 PR0100131 1000-000 2528 550 1,000.00

Account total: 1,000.00

6000-100 Salaries and wages expense 03/17/14 PR1000147 1000-000 2562 10 3,544.60

Account total: 3,544.60

6100-000 FICA tax expense 03/01/14 PR0100131 1000-000 2528 550 76.50

03/17/14 PR1000147 1000-000 2562 10 271.17

Account total: 347.67

6110-000 FUI tax expense 03/01/14 PR0100131 1000-000 2528 550 6.00

Account total: 6.00

6110-100 FUI tax expense 03/17/14 PR1000147 1000-000 2562 10 20.73

Account total: 20.73

6120-000 SUI tax expense 03/01/14 PR0100131 1000-000 2528 550 .72

Account total: .72

Grand total: .00

-- End of report --

Employee Gross Hours and Wages with Check Details

Date 06/09/2014 Time 11:10:03 XYZ Company Report-#0000000 Page 0001

E M P L O Y E E G R O S S H O U R S A N D W A G E S R E P O R T

Starting date: "Earliest" Ending date: "Latest" (By pay period date)

Starting employee: 1002 Ending employee: 1002

Entry types: P = payroll check A = adjustment V = advanced vacation T after Check# = ACH transaction

------------------------------------------------------------------------------------------------------------------------------------

Emp-# Name Typ Check# Chk-date Prd-date RegPay OvrPay VacPay HolPay SickPay SpecPay

Hrs Hrs Hrs Hrs Hrs Hrs

------------------------------------------------------------------------------------------------------------------------------------

1002 Levine, Susan M. P 482T 9/26/13 11/08/13 9,166.67 .00 .00 .00 .00 .00

86.67 .00 .00 .00 .00 .00

P 2534 2/01/14 3/13/14 9,166.67 .00 .00 .00 .00 .00

86.67 .00 .00 .00 .00 .00

P 2560T 2/01/14 9,166.67 .00 .00 .00 .00 .00

86.67 .00 .00 .00 .00 .00

P 2592 1/30/14 4/01/14 9,166.67 .00 .00 .00 .00 .00

86.67 .00 .00 .00 .00 .00

P 497T 10/31/14 10/31/14 9,166.67 .00 .00 .00 .00 .00

86.67 .00 .00 .00 .00 .00

Employee 1002 Totals: 5 trans 45,833.35 .00 .00 .00 .00 .00

433.35 .00 .00 .00 .00 .00

Grand totals: 1 employees 5 trans 45,833.35 .00 .00 .00 .00 .00

433.35 .00 .00 .00 .00 .00

-- End of report --

Date 06/20/2014 Time 16:44:17 XYZ Company Report-#0000000 Page 0001

E M P L O Y E E S B Y E M P L O Y E E N A M E

Starting employee: Prieskorn, Jeff

Ending employee: Prieskorn, Jeff

Employee types: H = hourly S = salary N = non-employee

Pay frequencies: D = daily W = weekly B = bi-weekly S = semi-monthly M = monthly Q = quarterly

------------------------------------------------------------------------------------------------------------------------------------

Emp-# Name Street City St Zip Soc-sec-# Emp Pay

type freq

------------------------------------------------------------------------------------------------------------------------------------

10 Prieskorn, Jeff 710 Delaware Street Detroit MI 48123 ***-**-8332 H M

Emp. notes: Date 1/16/09 Time 10:44

Received a Regular rate raise today of $2.00 an hour.

1 employees 0 daily 0 weekly 0 bi-weekly 0 semi-monthly 1 monthly 0 quarterly

-- End of report --

Date 06/09/2014 Time 10:46:15 XYZ Company PDF Generated Report Page 0001

E M P L O Y E E S B Y E M P L O Y E E #

Starting employee #: 1002 Ending employee #: 1002

Marital statuses: S = single M = married H = head of household

Employee types: H = hourly S = salary N = non-emp

Pay/Deduct freq: D = daily W = weekly B = bi-weekly S = semi-monthly M = monthly Q = quarterly

For deduction/earning codes see deduction/earning code list

Tax-pct-of-gross: 1 = FWT gross 4 = fed unemp gross 5 = state unemp gross 6 = work comp gross

7 = Emp soc sec gross 8 = Emp medicare gross 9 = Empr soc sec gross 10 = Empr medicare gross

SS = Social Security Mc = Medicare

------------------------------------------------------------------------------------------------------------------------------------

Emp-# Name Street City St Zip Phone-# Soc-sec-#

1002 Levine, Susan M. 5097 Windward Ave. Woodland Hills CA 91002 555-456-5522 ***-**-8795

Birth-dt Mar Hire-dt Lst-rais Revu-dt Term-dt Typ Frq W-Comp Dept Wage-account Grp Salary Reg-rate Ovt-rate

09/30/75 S 03/01/10 12/01/09 S S 0000 1010-000 9,166.67 105.765 158.648

Spec rate1 Spec W-Comp1 Spec desc1 Spec rate2 Spec W-Comp2 Spec desc2 Spec rate3 Spec W-Comp3 Spec desc3

211.530 SPEC .000 .000

Vac-due Vac-pd Sik-due Pen Dst Ins-prem Stax Ctax #/$-exm-FWT #/$-exm-SWT #/$-exm-OST-1 #/$-exm-OST-2

100.000 .000 11.000 N N CA-2 LA-A 0 .00 0 .00 0 .00 0 .00

$-exm-empr-OST #/$-exm-CWT State-crd Ad-FWT Ad-SWT Ad-CWT EIC SS? Mc? FUI? SUI? 401k Union /frq/account-#

.00 0 .00 .00 .00 .00 .00 N N N N Y .00 0000-000

Loan/frq/balance Garn /frq/balance

.00 .00 .00 .00

401K Frq Trad amt/rate/% Type Roth amt/rate/% Type Empr-401K Frq Amt/rate/% Type Max

4K1 W 65.00 amt C1 W 150.00 amt 2,500.00

D-E1/ amount /frq/balance-due D-E2/ amount /frq/balance-due D-E3/ amount /frq/balance-due D-E4/ amount /frq/balance-due

.00 (n/a) .00 (n/a) .00 (n/a) .00 (n/a)

D-E5/ amount /frq/balance-due D-E6/ amount /frq/balance-due D-E7/ amount /frq/balance-due D-E8/ amount /frq/balance-due

.00 (n/a) .00 (n/a) .00 (n/a) .00 (n/a)

D-E9/ amount /frq/balance-due Vac-date/Hrs-per-frq/Max-v-hrs/frq/Sick-date/Hrs-per-frq/Max-s-hrs/frq

.00 (n/a) 7/15/14 40.00000 100.000 Y 12/01/10 0.50000 100.000 M

YTD-gross YTD-FWT-gr YTD-emp-SoSc-gr YTD-emp-Mdcr-gr YTD-empr-SoSc-gr YTD-empr-Medc-gr YTD-FUI-gr YTD-W-Comp-gr

36,666.68 36,406.68 36,666.68 36,666.68 36,666.68 36,666.68 7,000.00 .00

YTD-supp-ben-gr YTD-SUI-gr YTD-FWT YTD-EIC YTD-emp-SoSc YTD-emp-Mdcr YTD-empr-SoSc YTD-empr-Mdcr YTD-SWT

.00 7,000.00 9,200.16 .00 2,273.32 531.68 2,273.32 531.68 2,988.30

YTD-OST-1 YTD-OST-2 YTD-Empr-OST YTD-CWT YTD-othr-tax YTD-401k YTD-Empr-401k Tot-hours YTD-tip-CR CR-elig

.00 .00 .00 1,092.20 .00 260.00 600.00 346.68 .00 N

Direct deposit account information:

ACH: Bank Name Account Typ Amount Meth Bank Name Account Typ Amount Meth

------------------------------------------------------------------------------------------------------------------------------------

DDP Last National Bank ***2163 Chk .00 Bal

-- End of report --

Date 06/09/2014 Time 11:19:48 XYZ Company Report-#0000000 Page 0001

E M P L O Y E E P A Y R O L L H I S T O R Y R E P O R T

Starting date: 10/01/2014 Ending date: "Latest" (By pay period date)

Starting employee: 1002 Ending employee: 1002

Entry types: P = payroll check V = advance vacation check A = adjustment B = bonus/separate suppl earning C = commission

------------------------------------------------------------------------------------------------------------------------------------

Emp# Name Typ Check-# Gross Soc-sec SWT Deductions Reg-hrs Wks-wrk State

Soc-sec-# Prd-date Chk-dat FWT-gross Medicare OST-1 Union Ovt-hrs Wrk-units /City

Csh-acct Chk-amt Net-pay FWT OST-2 Loan Spc-hrs Tips tax

DDP-Cash-acct Direct-dpst-acct Direct-dpst 401(k) CWT Garnishment EIC Meals codes

------------------------------------------------------------------------------------------------------------------------------------

1002 Levine, Susan M. P 497 9,166.67 568.33 724.87 .00 86.67 2.16 CA-2

***-**-8795 10/31/14 10/31/14 9,101.67 132.92 .00 .00 .00 .00 LA-A

1010-000 .00 5,102.46 2,300.04 .00 .00 .00 .00

1010-000 ***2163 DDP 5,102.46 65.00 273.05 .00 .00 .00

ACH: Bank Name Account Typ Amount Meth Bank Name Account Typ Amount Meth

DDP Last National Bank ***°°°° Chk 5,102.46 Bal

Employee 1002 totals: 1 trans 9,166.67 568.33 724.87 .00 86.67 2.16

9,101.67 132.92 .00 .00 .00 .00

5,102.46 2,300.04 .00 .00 .00 .00

5,102.46 65.00 273.05 .00 .00 .00

Grand totals:

1 employees 1 trans 9,166.67 568.33 724.87 .00 86.67 2.16

9,101.67 132.92 .00 .00 .00 .00

5,102.46 2,300.04 .00 .00 .00 .00

5,102.46 65.00 273.05 .00 .00 .00

Worker's comp grand totals: Class Subj-wages Rptd-units Total-prem

-- End of report --

Date 06/09/2014 Time 11:27:46 XYZ Company Report-#0000000 Page 0009

E M P L O Y E R P A Y R O L L E X P E N S E R E P O R T

Starting date: 10/01/2014 Ending date: "Latest" (By pay period date)

Starting employee: 1002 Ending employee: 1002 T after Check-# = ACH transaction

Entry types: P = payroll check V = advance vacation check A = adjustment B = bonus/separate suppl earning C = commission

------------------------------------------------------------------------------------------------------------------------------------

Emp# Name Typ Check-# Gross Soc-sec SUI Reg-hrs Wks-wrk State

Soc-sec-# Prd-date Chk-dat FWT-gross Medicare Empr-OST Ovt-hrs Wrk-units /City

Pay-desc/W-comp-code Csh-acct Chk-amt Net-pay FUI Suppl-ben Spc-hrs W-comp-prem tax

Spec-rate DDP-Cash-acct Direct-dpst-acct Direct-dpst 401(k) State-tip-cr Fed-tip-cr W-comp-gross codes

------------------------------------------------------------------------------------------------------------------------------------

1002 Levine, Susan M. P 497T 9,166.67 568.33 .00 86.67 2.16 CA-2

***-**-8795 10/31/14 10/31/14 9,101.67 132.92 .00 .00 .00 LA-A

REG 1010-000 .00 5,102.46 .00 .00 .00

.000 1010-000 ***2163 DDP 5,102.46 150.00 .00 .00 .00

Employee 1002 totals: 1 trans 9,166.67 568.33 .00 86.67 2.16

9,101.67 132.92 .00 .00 .00

5,102.46 .00 .00

5,102.46 150.00 .00 .00 .00

Grand totals:

1 employees 1 trans 9,166.67 568.33 .00 86.67 2.16

9,101.67 132.92 .00 .00 .00

5,102.46 .00 .00

5,102.46 150.00 .00 .00 .00

-- End of report --

Date 06/09/2014 Time 11:59:18 XYZ Company Report-#0000000 Page 0001

L E A V E R E P O R T

Starting department: "First" Ending department: "Last"

Starting employee: 10 Ending employee: 10

Starting date: 10/01/2014 Ending date: "Latest" (By pay period date)

------------------------------------------------------------------------------------------------------------------------------------

Emp# Name

------------ Annual-hours -------------- -------------- Sick-hours ---------------

Prd-date Beg-due Accrued Used End-due Beg-due Accrued Used End-due

------------------------------------------------------------------------------------------------------------------------------------

Department: 1200

Employee: 10 Prieskorn, Jeff

10/31/14 45.000 5.000 .000 50.000 8.000 .000 .000 8.000

11/30/14 50.000 5.000 .000 55.000 8.000 .000 .000 8.000

Employee 10 Total 10.000 .000 .000 .000

Dept 1200 Total 10.000 .000 .000 .000

--------------------------------------------------------------------------------

Date 06/09/2014 Time 11:59:18 XYZ Company Report-#0000000 Page 0002

L E A V E R E P O R T

------------------------------------------------------------------------------------------------------------------------------------

Emp# Name

------------ Annual-hours -------------- -------------- Sick-hours ---------------

Prd-date Beg-due Accrued Used End-due Beg-due Accrued Used End-due

------------------------------------------------------------------------------------------------------------------------------------

Grand totals: 10.000 .000 .000 .000

-- End of report --

Date 06/09/2014 Time 13:40:00 XYZ Company Report-#0000000 Page 0004

Q U A R T E R L Y P A Y R O L L R E P O R T

Quarter # 3 ending: 9/30/14 Federal unemployment %: .60

Company: XYZ Company

Address: P.O. Box 400

Merrimack, NH 03227

Federal ID#: 77-XXXXXXX

Notes: Reported tips are included in gross amounts according to tip earning codes.

"Total hours" includes regular, overtime and special hours only.

"Wages over FUI max" for this quarter are obtained using the wages for this quarter AND all previous quarters.

------------------------------------------------------------------------------------------------------------------------------------

Emp-# Name Gross-pay Emp-soc-sec-wgs Emp-soc-sec-tips Emp-soc-sec FWT-grs FWT

Soc-sec-# Reported-tips Emp-medicare-wgs Emp-medicare-tips Emp-medicare Emp-401(k)-ded Empr-401(k)-amt

Earn-income-cr Empr-soc-sec-wgs Empr-soc-sec-tips Empr-soc-sec FUI-grs FUI

Tot-hrs Empr-medicare-wgs Empr-medicare-tips Empr-medicare Wgs-over-FUI-max Wks-wrk

------------------------------------------------------------------------------------------------------------------------------------

113131 Carlos, Juan 100.00 100.00 200.00 18.60 300.00 29.78

xxx-xx-9987 200.00 100.00 200.00 4.35 .00 .00

.00 100.00 200.00 18.60 300.00 1.80

40.00 100.00 200.00 4.35 .00 1.00

--------------------------------------------------------------------------------

Date 06/09/2014 Time 13:40:00 XYZ Company Report-#0000000 Page 0005

Q U A R T E R L Y P A Y R O L L R E P O R T

Quarter # 3 ending: 9/30/14 Federal unemployment %: .60

Company: XYZ Company

Address: P.O. Box 400

Merrimack, NH 03227

Federal ID#: 77-XXXXXXX

Notes: Reported tips are included in gross amounts according to tip earning codes.

"Total hours" includes regular, overtime and special hours only.

"Wages over FUI max" for this quarter are obtained using the wages for this quarter AND all previous quarters.

------------------------------------------------------------------------------------------------------------------------------------

Gross-pay Emp-soc-sec-wgs Emp-soc-sec-tips Emp-soc-sec FWT-grs FWT

Reported-tips Emp-medicare-wgs Emp-medicare-tips Emp-medicare Emp-401(k)-ded Empr-401(k)-amt

Earn-income-cr Empr-soc-sec-wgs Empr-soc-sec-tips Empr-soc-sec FUI-grs FUI

Tot-hrs Empr-medicare-wgs Empr-medicare-tips Empr-medicare Wgs-over-FUI-max Wks-wrk

------------------------------------------------------------------------------------------------------------------------------------

Federal totals: 100.00 100.00 200.00 18.60 300.00 29.78

200.00 100.00 200.00 4.35 .00 .00

.00 100.00 200.00 18.60 300.00 1.80

40.00 100.00 200.00 4.35 .00 1.00

* Federal Return Information *

Emp soc sec percent: 6.20 Empr soc sec percent: 6.20 FUI percent: .60

Emp soc sec max wages: 117,000.00 Empr soc sec max wages: 117,000.00 FUI max wages: 7,000.00

Emp medicare percent: 1.45 Empr medicare percent: 1.45

Emp medicare max wages: .00 Empr medicare max wages: .00

Calculated taxes:

FUI = FUI-gross x FUI-% = 300.00 x .60% = 1.80

Emp-soc-sec = Emp-soc-sec-grs x Emp-soc-sec-% = 300.00 x 6.20% = 18.60

Emp-medicare = Emp-medicare-grs x Emp-medicare-% = 300.00 x 1.45% = 4.35

Empr-soc-sec = Empr-soc-sec-grs x Empr-soc-sec-% = 300.00 x 6.20% = 18.60

Empr-medicare = Empr-medicare-grs x Empr-medicare-% = 300.00 x 1.45% = 4.35

-- End of report --

Date 06/20/2014 Time 16:56:22 XYZ Company PDF Generated Report Page 0001

U N I O N D E D U C T I O N S R E P O R T

Starting pay period date: "Earliest" Ending pay period date: "Latest"

------------------------------------------------------------------------------------------------------------------------------------

Soc-sec-# Name -------------Hours------------ #-of Wks Subj-pay Calc Union

Regular Overtime Special trans method deduction

------------------------------------------------------------------------------------------------------------------------------------

For union account # 2050-000 Union dues deduct payable

***-**-8912 Lopez, Felicia J. 160.00 .00 20.00 5 4.00 4,400.00 per payprd 25.00

Union totals: 160.00 .00 20.00 5 4.00 4,400.00 25.00

-- End of report --

Date 06/09/2014 Time 13:29:57 XYZ Company Report-#0000000 Page 0003

Y E A R - E N D P A Y R O L L R E P O R T

Company: XYZ Company State: CA Single State ID:

Address: P.O. Box 400 City: LA All City ID:

Merrimack, NH 03227

Fed ID: 77-XXXXXXX

------------------------------------------------------------------------------------------------------------------------------------

Emp-# Soc-Sec-# ---1st-qtr--- ---2nd-qtr--- ---3rd-qtr--- ---4th-qtr--- Year-total

------------------------------------------------------------------------------------------------------------------------------------

1002 ***-**-8795 Grs-wages: 27,500.01 .00 .00 9,166.67 36,666.68

Name: Susan M. Levine Emp-401(k)-ded: 195.00 .00 .00 65.00 260.00

Addr: 5097 Windward Ave. FWT-gross: 27,305.01 .00 .00 9,101.67 36,406.68

Woodland Hills FWT-w/h: 6,900.12 .00 .00 2,300.04 9,200.16

CA 91002 Emp-soc-sec-wgs: 27,500.01 .00 .00 9,166.67 36,666.68

Emp-soc-sec-tips: .00 .00 .00 .00 .00

Emp-soc-sec-w/h: 1,704.99 .00 .00 568.33 2,273.32

Earning categories year tots: Emp-medicare-wgs: 27,500.01 .00 .00 9,166.67 36,666.68

Reg-pay: 36,666.68 Emp-medicare-tips: .00 .00 .00 .00 .00

Ovt-pay: .00 Emp-medicare-w/h: 398.76 .00 .00 132.92 531.68

Spec-pay: .00 SWT-gross: 27,305.01 .00 .00 9,101.67 36,406.68

Vac-pay: .00 SWT-w/h: 2,263.43 .00 .00 724.87 2,988.30

Hol-pay: .00 OST-1-gross: .00 .00 .00 .00 .00

Sick-pay: .00 OST-1-w/h: .00 .00 .00 .00 .00

OST-2-gross: .00 .00 .00 .00 .00

OST-2-w/h: .00 .00 .00 .00 .00

Deduction categories year tots: CWT-gross: 27,305.01 .00 .00 9,101.67 36,406.68

Garnish: .00 CWT-w/h: 819.15 .00 .00 273.05 1,092.20

Loan: .00 Empr-401(k)-amt: 450.00 .00 .00 150.00 600.00

Union: .00 Empr-soc-sec-wgs: 27,500.01 .00 .00 9,166.67 36,666.68

Empr-soc-sec-tips: .00 .00 .00 .00 .00

Empr-soc-sec-tax: 1,704.99 .00 .00 568.33 2,273.32

Empr-medicare-wgs: 27,500.01 .00 .00 9,166.67 36,666.68

Empr-medicare-tip: .00 .00 .00 .00 .00

Empr-medicare-tax: 398.76 .00 .00 132.92 531.68

W/Comp-gross: .00 .00 .00 .00 .00

Est-W-Comp-prem: .00 .00 .00 .00 .00

FUI-gross: 7,000.00 .00 .00 .00 7,000.00

FUI: 42.00 .00 .00 .00 42.00

SUI-gross: 7,000.00 .00 .00 .00 7,000.00

SUI: 238.00 .00 .00 .00 238.00

Empr-OST-gross: .00 .00 .00 .00 .00

Empr-OST: .00 .00 .00 .00 .00

Suppl-ben-grs: .00 .00 .00 .00 .00

Suppl-ben: .00 .00 .00 .00 .00

Reported-tips: .00 .00 .00 .00 .00

Fed-tip-cr: .00 .00 .00 .00 .00

State-tip-cr: .00 .00 .00 .00 .00

-- End of report --